Competition Analysis

There are three types of competitors for BWB: Bricks-and-mortars, online stores and bricks-and-clicks. Figure 8 shows the sales by sort of booksellers within the book retail market for the year 2014 (excluding bricks-and-clicks).

Nonetheless, 3 of them hold together more than 20% of the market share with no relevant gap between them. Therefore, they are interesting to consider:

-

Thalia Holding: It has more than 200 bookshops in Germany and it is the biggest bookstore chain in the country. The company is also suffering from digitalization of the book industry (sales in 2013 accounted for 915 million euros versus 1.2 billion in 2012).Nevertheless, Thalia created e-stores to follow suite with the changing consumers’ behaviour and with the transforming landscape of the German book market. Moreover, it has developed an e-reader, OYO. Thalia has also, in cooperation with other book retailers (such as Weltbild, Hugendubel, Club Bertelsmann etc.), created an important e-reader, the Tolino[2] reader. Tolino held in 2014 a 44% market share of ebooks sold in Germany over Amazon’s 39%, as reported by Publishing Perspectives analyst.

-

German Booksellers GMBH (DBH): The Company has more than 500 stores in Germany, Switzerland and Austria. It holds 50% shares of two gigantic in the retail industry: Hugendubel Holding Inc. with annual sales of 300 million euros in 2011 and 30 department-stores spread all over the country. It has also a classic e-store in which customers can buy e-books, physical books, e-readers (Tolino) and even audio & video versions. (No used books assessed)

-

The second big retailer that was held by DHB is Weltbild with annual sales of 1.6 billion euros and with more than 300 bricks-and-mortar outlets (and more than 6.000 employees). The latter had become number two in online book retail in Germany, following Amazon. (No used books assessed)

Although Weltbild had a successful story, in 2014 it went bankrupt (Wischenbart, 2014) because the company could not compete against Amazon. The company is now trying to attract new investors to help it stand back again. In 2014, after the announcement of bankruptcy, Droege international group bought 60% of Weltbild to recapitulative it and help it restore its position and history in the German book retail industry.

-

Mayersche Buchhandlung: Their annual sales in 2010 reached 160 million euros with more than 40 bookshops in Germany. This company has an online store as well. (No used books assessed)

-

Amazon: Moreover, Amazon is also a big player (Wyman, 2015), number one e-retailer in accordance with the Ecommerce News agency, 2015) in the German book retailer market. Therefore, an assessment on its market position must be made. Its arrival to Germany with its Kindle worsened the situation for the big retailers by creating a cutthroat competition setting. The US Company had total sales of $8.7 billion in Germany in 2012 (more than in the UK)! Strengths of the US giant in Germany (and worldwide) are its introduction of prime service to enabling same-day delivery and pushing for Sunday provisions. Besides, Amazon knew that relying on the use of postal services would not hold for long, and so it invested heavily in regional warehouses, a powerful IT backbone, and detailed analytics. Amazon also sells e-books (with Kindle tablet), physical books (both new and used) as well as different products. Albeit Amazon has had a success in Germany, unbearable working conditions (cf. supra) for a majority of Amazon’s workers (in warehouses) induced criticisms to the US company’s policy and therefore, ruined its trustworthiness vis-à-vis the labour force and the union. Thereby, strikes take place in Amazon’s warehouses in Germany regularly.

-

A last category of potential competitor of BWB is the used-books market. There are platforms that offer second-hand books. They are either e-stores such as AbeBooks.de, Amazon.de, Bookfinder.com, Antiquarische Bücher, BOL Germany, Buecher.de etc. or they can also be bricks-and-mortar such as Saint Georges English Bookshop, Luders, Bucherbogen, and the British Bookshop KG etc.

[1] There were some strikes in Germany to raise pay for warehouse workers in accordance with collective bargaining agreements in Germany’s mail order and retail industry. Besides, excessive pressure, rigid workplace controls, high sickness rates and arbitrary decisions, such as a cut in annual holidays provoked also an angry riot against Amazon.

[2] The Tolino has a touch screen, a battery life of up to 7 weeks and can store around 2,000 books. Thalia said it would be selling the device at 99 euros. However, the cheapest Kindle on amazon.de is 79 euros.

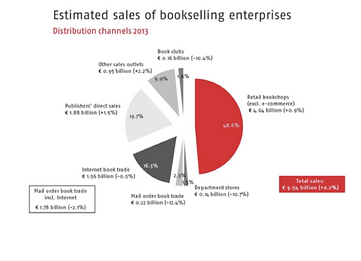

In 2013, the overall growth rate reached 0.2% with several ups-and-downs within each category. The biggest category is the retail stores (which is included in the bricks-and-mortar segment) with 48.6% of the total market and a positive drift. On the other hand, the online stores have seen an important decline of 0.5%. According to Frankfurter Buchmesse, this trend can be explained by two possible reasons. The first one is the new attitude among consumers, who are now consciously turning to regional sources for their shopping and the second reason consists of ‘the sustained bad press for the major player Amazon with regard to its employment policy[1]’.

Thousands of book retailers (cf. supra) are operating in the German’s market. The top ten booksellers in the German market by decreasing order (in market share) are: Thalia, DBH, Mayersche, Schweitzer Fachinformation, Libro, Orell, Lehmanns, Galeria Kaufhof, Osiander and Morawa.

One should note that the majority of these booksellers are holdings. In other words, they possess many bookstores with different brands.